Filing An Insurance Claim After A Storm

Following a major storm, filing an insurance claim may not be the first thing on your mind. Many people spend the days following a storm cleaning their yards, picking up their fences, and waiting for their power to come on, while others may look for shelter because of serious damage done to their homes from flooding or falling debris. The aftermath of a serious storm can be a devastating and stressful experience, but it is also the perfect time to evaluate the damage done to your property so restoration can begin. Whether you have experienced minimal or severe damage to your home, you may be eligible for reimbursement for repairs from your home insurance company. Review our recommended procedure for filing a claim with your insurance company to help avoid a claim dispute. If your claim has been denied or you feel your insurance company isn’t acting quickly or appropriately, call the Law Offices of Michael B. Brehne, PA, to schedule an initial consultation and get the help you need with your insurance claim!

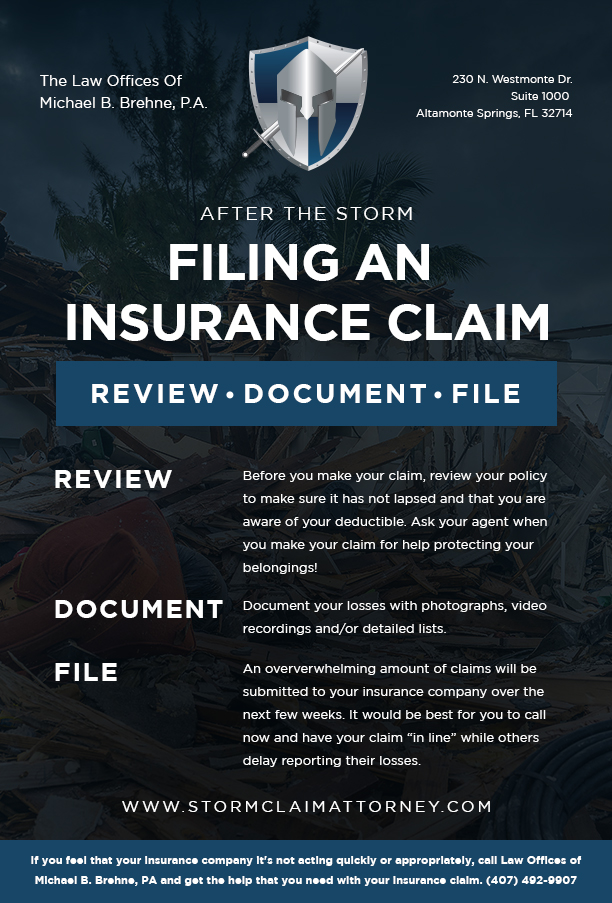

Review Your Policy

Before you file a claim with your home insurance company, review your policy to ensure it is up to date and active. Also, check for your hurricane deductible and whether the insurance company must reimburse you with “replacement cost value” or “actual cash value.” This information is contained within your policy. If you cannot find this information, ask the insurance representative when you report your loss. Understanding your policy language will let you know what you are entitled to from your insurance company.

Document Your Losses

It is essential to document your losses with photographs, video recordings, and detailed lists of property lost or damaged, as this will be used as evidence for insurance adjusters to verify the damage caused by the storm. Proper loss reporting allows the claim to progress more efficiently.

File Your Claim

After severe weather, insurance companies may be overwhelmed with claims, which can delay communication and resolution. Try to file a claim as soon as possible to begin the process. Once the claim process begins and the damage evidence is filed and saved, repairs can begin. If you have water damage, your insurance company may work directly with a water mitigation company and dispatch them to your home. Or they will advise you to choose a water mitigation company that will bill your insurance directly. If you have or suspect roof damage, reach out to a local roofing company so they can document your damage and reach out to your insurance company directly. If the circumstances require, they can also place temporary tarps on your home to avoid further water intrusion while the claim processes.

How Our Insurance Attorneys Can Help

Our experienced insurance attorney can be an advocate for you if your insurance company wrongfully denied your claim or is acting inappropriately. Insurance disputes can impact the safety and comfortability of your home and your financial livelihood. For a reliable lawyer and a voice against large insurance companies, contact the Law Offices of Michael B. Brehne, PA, today!